American Express Business Platinum Card Review

Introduction

Welcome to our comprehensive review of the American Express Business Platinum Card. If you’re a business owner looking for a credit card that can take your rewards game to the next level, look no further. The Business Platinum Card offers a wide range of benefits and perks designed to support your business and enhance your travel experiences.

Designed for small business owners and entrepreneurs, this card provides a tailored set of features to help streamline your expenses, earn rewards, and enjoy exclusive perks. Whether you’re a frequent traveler or you simply want to maximize your everyday spending, the Business Platinum Card has you covered.

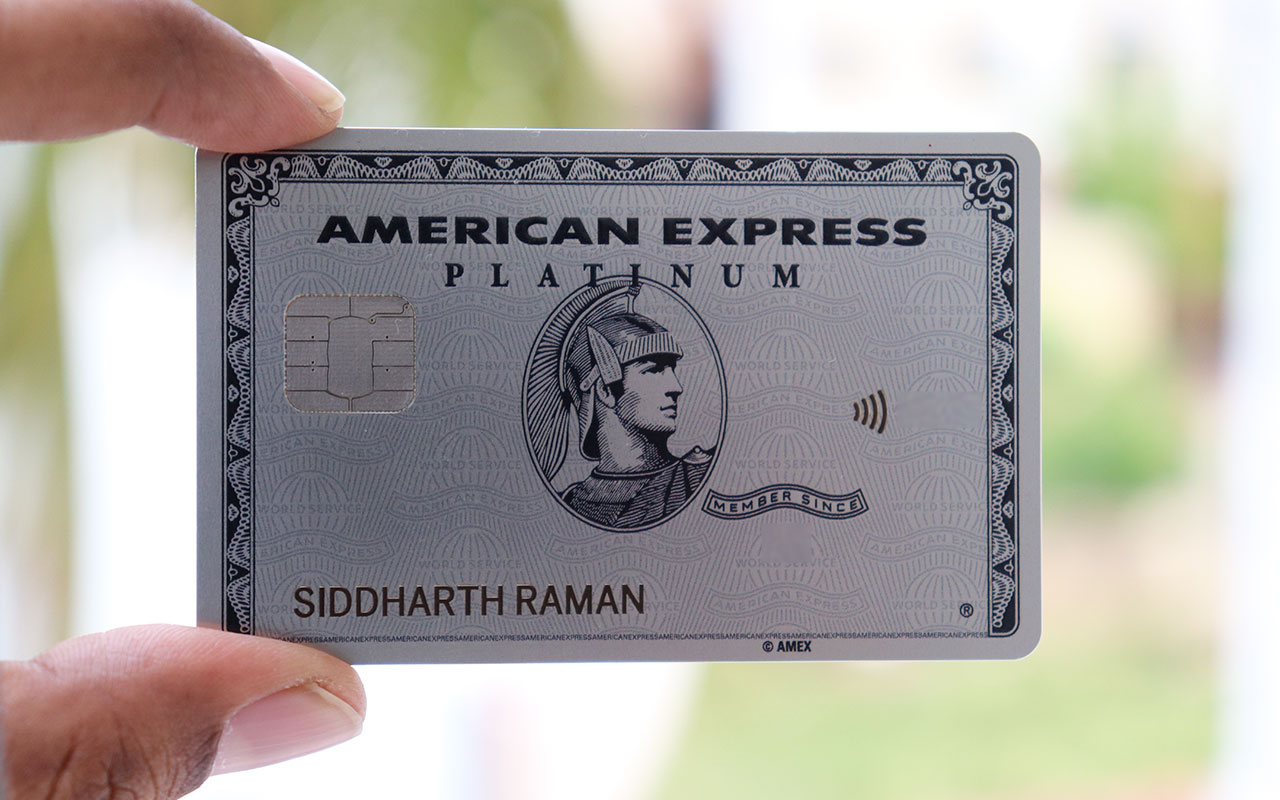

With its sleek and sophisticated design, the Business Platinum Card represents a commitment to excellence and professionalism. From its impressive rewards program to its premium customer service, this card offers a world of opportunities for businesses of all sizes.

In this review, we’ll delve into the eligibility criteria, the application process, the card benefits, the rewards program, the annual fee, the travel benefits, the business tools and services, and the customer support. By the end of this article, you’ll have a clear understanding of whether the American Express Business Platinum Card is the right fit for your business needs.

So, let’s dive in and discover all the remarkable features and advantages that the Business Platinum Card has to offer!

Eligibility and Application Process

The American Express Business Platinum Card is targeted towards small business owners and entrepreneurs. To be eligible for this card, you must have a registered business entity and an excellent credit history. The business entity can range from a sole proprietorship to a corporation.

The application process is relatively straightforward. You can apply for the Business Platinum Card online, directly through the American Express website. Simply provide the required information, including your personal and business details, and submit the application. American Express will assess your application and determine your eligibility based on their criteria.

When applying, it’s important to provide accurate and up-to-date information. American Express may request additional documentation or clarification if needed. It’s also worth noting that the Business Platinum Card requires a higher credit score compared to some other credit cards, so it’s important to ensure your credit profile is strong before applying.

If you are approved for the card, you can expect to receive it within a few business days. Activation instructions will be provided, and you’ll be able to start using your new Business Platinum Card right away.

It’s essential to review the terms and conditions of the card before applying. Pay attention to the annual fee, interest rates, and any additional fees that may apply. Additionally, understand the minimum spending requirements, if any, to qualify for any sign-up bonuses or rewards.

Overall, the eligibility requirements for the American Express Business Platinum Card are clear and straightforward. As long as you meet the criteria for a small business owner and have a strong credit history, you have a good chance of being approved for this prestigious card.

Card Benefits

The American Express Business Platinum Card offers a host of valuable benefits that can enhance both your business and travel experiences. Here are some key benefits to consider:

1. Membership Rewards Program: With the Business Platinum Card, you can earn Membership Rewards points on all your eligible purchases. These points can be redeemed for a variety of options, including flights, hotel stays, merchandise, and more.

2. Welcome Bonus: As a new cardholder, you may be eligible for a generous welcome bonus. This bonus typically requires you to meet a minimum spending threshold within a specified period, providing you with a head start on earning rewards.

3. Airport Lounge Access: Business Platinum Cardholders enjoy access to a wide range of airport lounges globally. This means you can relax and unwind in luxury lounges, regardless of the airline or class of service you’re traveling on.

4. Fine Hotels and Resorts Program: By being a Business Platinum Cardmember, you can enjoy exclusive benefits when booking stays at participating hotels through the Fine Hotels and Resorts program. These benefits may include room upgrades, late checkout, complimentary breakfast, and more.

5. Travel Insurance Coverage: When you use your Business Platinum Card to book your travel, you’ll receive a range of insurance coverage, including trip cancellation/interruption insurance, baggage insurance, and car rental loss and damage insurance.

6. Global Entry or TSA PreCheck Credit: As a Business Platinum Cardmember, you can receive a statement credit for the application fee when you apply for Global Entry or TSA PreCheck. This can help you breeze through security and customs during your travels.

7. Business Expenses Management Tools: American Express provides you with tools and resources to help manage your business expenses efficiently. From expense management systems to the option of adding employee cards with customized spending limits, you can keep track of your business expenses effortlessly.

8. Purchase Protection: When you make eligible purchases with your Business Platinum Card, you’ll receive purchase protection coverage against theft or accidental damage for a specified period after purchase. This can provide valuable peace of mind.

9. 24/7 Customer Service: American Express offers exceptional customer service, available 24/7, to handle any inquiries or assistance you may need. From lost card replacement to dispute resolution, their dedicated team is there to support you.

These are just a few of the many benefits that the American Express Business Platinum Card provides. With its array of rewards, perks, and business tools, this card is designed to support and enhance your business operations and travel experiences.

Rewards Program

The American Express Business Platinum Card offers a robust rewards program that allows cardholders to earn valuable Membership Rewards points on their everyday business expenses. Here’s what you need to know about the rewards program:

Earning Points: With the Business Platinum Card, you can earn Membership Rewards points on all eligible purchases. Every dollar spent on eligible purchases will earn you a certain number of points, which can quickly accumulate over time. Additionally, American Express often offers bonus point opportunities for specific categories or promotions.

Flexible Redemption Options: Membership Rewards points can be redeemed for a variety of options, making it easy to find something that suits your needs. You can use your points towards travel bookings, including flights and hotels, or transfer points to a variety of airline and hotel loyalty programs. Points can also be redeemed for merchandise, gift cards, statement credits, and more.

Transfer Partners: A significant advantage of the Membership Rewards program is the ability to transfer points to various airline and hotel loyalty programs. This allows you to leverage your points for potentially higher value and access additional travel benefits offered by these programs.

Membership Rewards Exclusives: American Express often offers exclusive experiences and special events for Membership Rewards members. These may include access to pre-sale tickets, VIP experiences, and unique offers that can make your rewards even more exciting.

Points Redemption Tools: American Express provides online tools that make it easy to track and redeem your Membership Rewards points. You can review your points balance, explore redemption options, and even book travel directly through the Membership Rewards portal.

Bonus and Welcome Offers: The Business Platinum Card often comes with a generous welcome bonus for new cardholders. This bonus typically requires meeting a minimum spending threshold within a specific time frame. It is essential to review the terms of any bonus offers to ensure you qualify and understand the requirements.

The Membership Rewards program is known for its flexibility and value. Whether you’re looking to maximize your travel rewards, redeem for merchandise, or transfer points to loyalty programs, the rewards program associated with the American Express Business Platinum Card provides you with a myriad of options.

It’s important to note that redemption values and options are subject to change, so it’s always a good idea to stay up to date with the latest program details and promotions provided by American Express. By strategically earning and redeeming your points, you can make the most of the Business Platinum Card’s rewards program and enjoy the benefits of your hard-earned points.

Annual Fee

Like many premium credit cards, the American Express Business Platinum Card does come with an annual fee. However, considering the range of benefits and perks it offers, the fee can be well worth it for many business owners. Here’s what you need to know about the annual fee:

Annual Fee Amount: The current annual fee for the Business Platinum Card is [insert specific annual fee amount]. This fee is charged on a yearly basis and will appear on your billing statement.

Value and Return on Investment: While the annual fee may seem steep, it’s important to consider the value and return on investment that the card provides. The benefits, rewards, and exclusive perks can far outweigh the cost of the annual fee for those who take advantage of them regularly.

Benefits Justifying the Fee: The Business Platinum Card offers a range of benefits that can help justify the annual fee. These include airport lounge access, travel credits, statement credits for Global Entry or TSA PreCheck, annual travel credits, and elite status with hotel loyalty programs, among others.

Bonus Offers and Upgrades: American Express often provides bonus offers and upgrade opportunities for Business Platinum Cardmembers. These can include statement credits, additional rewards, or reduced annual fees for certain spending thresholds or usage of specific benefits.

Business Expense Deductibility: In many cases, the annual fee for business credit cards can be tax-deductible as a legitimate business expense. It’s essential to consult with a tax professional or accountant to understand the specific deductibility rules and requirements related to your business.

Fee Waived for Additional Employee Cards: If you need to add employee cards to your Business Platinum Card account, you’ll be pleased to know that you can add them at no additional cost. This allows you to take advantage of the rewards and benefits while managing your business expenses.

While the annual fee should be considered when deciding on the Business Platinum Card, it’s important to evaluate the overall value it provides. If you travel frequently, utilize the airport lounge access, make use of the travel credits, and enjoy the additional benefits, the annual fee can easily be outweighed by the value and savings you receive.

Ultimately, individuals must assess their business needs, spending habits, and travel requirements to determine if the benefits and rewards of the card justify the annual fee. For many small business owners and entrepreneurs, the American Express Business Platinum Card is a worthwhile investment that can significantly enhance their business and travel experiences.

Travel Benefits

The American Express Business Platinum Card offers a wide array of travel benefits that can take your journeys to new heights. Whether you’re a frequent traveler or just planning a few trips a year, these benefits can enhance your travel experience and provide added peace of mind. Here are some notable travel benefits of the Business Platinum Card:

Airline Fee Credit: Cardholders are eligible for an airline fee credit of up to [insert amount] per calendar year. This credit can be used towards incidental fees such as baggage fees, in-flight meals, and airport lounge day passes. This benefit allows you to offset some travel expenses and enjoy a more comfortable journey.

Airport Lounge Access: Gain access to exclusive airport lounges with the Business Platinum Card. You’ll have access to the American Express Global Lounge Collection, which includes The Centurion Lounges, Priority Pass lounges, Delta Sky Club lounges, and more. Relax, recharge, and enjoy complimentary amenities and services before your flights.

Hotel Elite Status: Enjoy complimentary hotel elite status with participating hotel loyalty programs. This can provide benefits such as room upgrades, late checkout, and access to exclusive amenities and services. Take your hotel stays to the next level and enjoy added perks while you travel.

Fine Hotels and Resorts Program: Through the Fine Hotels and Resorts program, Business Platinum Cardmembers can enjoy valuable benefits at participating luxury hotels worldwide. These benefits may include room upgrades, daily breakfast, late checkout, and hotel credits for dining or spa services. Make your hotel stays even more memorable with these exclusive offerings.

No Foreign Transaction Fees: When traveling internationally, the Business Platinum Card can save you money on foreign transaction fees. You can make purchases abroad without incurring additional fees, making it a convenient option for those who frequently travel internationally or conduct business with international partners.

Travel Insurance Coverage: The Business Platinum Card provides comprehensive travel insurance coverage, offering peace of mind when unexpected events occur. Coverage may include trip cancellation/interruption insurance, baggage insurance, travel accident insurance, and car rental loss and damage insurance. Travel with confidence knowing that you are protected.

Global Assistance and Emergency Support: Should you encounter any difficulties while traveling, American Express is there to assist you. They offer global assistance and emergency support services, providing you with 24/7 access to medical, legal, and financial support.

These travel benefits can significantly enhance your travel experiences, providing you with added comfort, convenience, and value. Whether it’s enjoying a quiet lounge before your flight, receiving room upgrades at luxury hotels, or having access to travel insurance coverage, the Business Platinum Card ensures you can focus on making the most of your journey.

Business Tools and Services

The American Express Business Platinum Card offers a range of valuable business tools and services designed to streamline your operations and help you manage your expenses more efficiently. Here are some notable business tools and services that come with the card:

Expense Management Systems: American Express provides business owners with access to a variety of expense management tools. These tools help you track and categorize your business expenses, making it easier to monitor your spending and simplify the accounting process.

Add Employee Cards: With the Business Platinum Card, you have the option to add employee cards to your account. These cards can have custom spending limits and let you earn rewards on your employees’ business expenses. Additionally, you can track their spending separately for easy expense management.

Online Account Access: Manage your Business Platinum Card account conveniently through American Express’ online portal. Get real-time access to your account balance, view statements, make payments, and track transactions, all from the comfort of your own computer or mobile device.

ReceiptMatchSM: This feature allows you to upload receipts and match them to your card transactions. It simplifies the process of reconciling expenses and provides easy access to digital receipt copies for record-keeping or reimbursement purposes.

Tax and Financial Reporting: American Express provides detailed transaction and expense reports that can make tax preparation and financial reporting more efficient. These reports can be customized to your specific business needs, helping you stay organized and compliant.

OPEN Forum: Business Platinum Cardmembers gain access to American Express’ OPEN Forum, an online resource center that provides educational and networking opportunities for small business owners. Get insights, advice, and inspiration from experts and fellow entrepreneurs to help you grow your business.

Vendor Pay by Bill.com: Simplify your accounts payable process with Vendor Pay by Bill.com. This feature allows you to pay vendors electronically, saving time on paperwork and eliminating the need for checks. It provides a seamless and secure way to manage your business payments.

These business tools and services can make a significant difference in managing your business expenses and streamlining your operations. By leveraging the resources provided by the Business Platinum Card, you can focus more on growing your business and less on administrative tasks.

Customer Support

American Express is known for providing exceptional customer support, and as a Business Platinum Cardmember, you can expect the same level of service. Whether you have questions about your account, need assistance with a transaction, or require help while traveling, their dedicated support team is available to assist you. Here’s what you can expect from their customer support:

24/7 Support: American Express offers 24/7 customer support, ensuring that help is available whenever you need it. Whether you’re in a different time zone or facing an urgent matter, you can reach their support team anytime, day or night.

Phone Support: The fastest and most direct way to get in touch with American Express customer support is by calling the number provided on the back of your Business Platinum Card. Their knowledgeable and friendly representatives are ready to answer your questions and provide solutions to any issues you may encounter.

Online Chat: If you prefer to communicate online, American Express offers an online chat feature on their website and mobile app. This allows you to have a real-time conversation with a customer support representative, providing quick and convenient assistance.

Email Support: If your inquiry is not time-sensitive, you can also reach out to American Express via email. They typically respond within 24 to 48 hours, addressing your questions or concerns in a thorough and prompt manner.

Mobile App Support: American Express has a user-friendly mobile app that allows you to manage your account, make payments, and contact customer support directly from your smartphone or tablet. This provides an additional avenue to access support wherever you are.

Dispute Resolution: In the rare event that you encounter a billing error or have a dispute with a merchant, American Express offers a robust dispute resolution process. They will work with you to investigate and resolve the issue, ensuring your satisfaction and protecting your interests.

American Express is committed to providing exceptional customer service and is known for its high customer satisfaction ratings. Their customer support staff is well-trained and dedicated to addressing your needs promptly and effectively, making your experience as a Business Platinum Cardmember a positive one.

Pros and Cons

When considering the American Express Business Platinum Card, it’s important to weigh the pros and cons to determine if it aligns with your business needs and priorities. Here are some key advantages and considerations to help you make an informed decision:

Pros:

- The Business Platinum Card offers a generous rewards program, allowing you to earn valuable points on your business spending.

- Access to a wide range of travel benefits, including airport lounge access, hotel elite status, and travel insurance coverage.

- Business tools and services such as expense management systems, employee cards with spending limits, and online account access for easy expense tracking.

- Complimentary hotel upgrades, late checkouts, and other perks through the Fine Hotels and Resorts program.

- Exceptional customer support available 24/7, ensuring your questions and concerns are addressed promptly.

- The card can help you establish and build business credit, which can be beneficial for future financing needs.

- Opportunities for bonus offers and upgrade opportunities that can provide additional value and rewards.

Cons:

- The American Express Business Platinum Card comes with a high annual fee, which may not be suitable for businesses with lower spending or those that do not fully utilize the benefits.

- The rewards program may have airline and hotel transfer partners that may not align with your travel preferences or loyalty.

- The card may require a higher credit score for approval, which can be a barrier for some business owners.

- American Express is widely accepted, but there may still be some merchants or locations where the card may not be readily accepted.

- Certain benefits, such as airport lounge access, may not be as useful for individuals who do not travel frequently.

- The perks and benefits associated with the Business Platinum Card may be more suitable for larger businesses with higher spending volumes.

Ultimately, the decision to apply for the American Express Business Platinum Card should be based on your individual business needs, spending habits, and goals. Consider the rewards, benefits, and potential drawbacks to determine if the card’s features align with your requirements and can provide sufficient value to justify the annual fee.

Conclusion

The American Express Business Platinum Card offers a wealth of benefits and rewards specifically tailored to meet the needs of small business owners and entrepreneurs. With its robust rewards program, extensive travel benefits, and array of business tools and services, the Business Platinum Card can be a valuable asset for managing your business expenses and enhancing your travel experiences.

By earning Membership Rewards points on your everyday business spending, you can maximize your rewards and redeem them for a variety of options, including travel bookings, merchandise, and more. The card’s travel benefits, such as airport lounge access and hotel elite status, provide added comfort and convenience during your journeys.

Moreover, the Business Platinum Card offers an impressive suite of business tools and services to streamline expense management and help you stay organized. Additionally, the card’s exceptional customer support and dispute resolution process ensure that you receive assistance promptly and efficiently.

However, it’s important to consider the higher annual fee associated with the card and evaluate whether the benefits and rewards offered align with your business needs and justify the cost. For small businesses with significant travel and expense requirements, the Business Platinum Card can deliver a remarkable return on investment.

In conclusion, the American Express Business Platinum Card is a powerful financial tool that can support your business growth and elevate your travel experiences. It offers a comprehensive range of benefits, rewards, and services that cater to the unique needs of small business owners. By leveraging its features strategically, you can make the most of your business expenses, enjoy exclusive travel perks, and streamline your operations. Consider your business goals and spending habits carefully to determine if the American Express Business Platinum Card is the right fit for you and can provide the value that your business deserves.