How Do I Add A Virtual Card To Apple Wallet

Introduction

Welcome to the world of digital wallets and virtual cards! In this modern age of technology, traditional physical cards are increasingly being replaced by their virtual counterparts. With the advent of services like Apple Wallet, managing your cards and making payments has become more convenient than ever.

But you might be wondering, what exactly is a virtual card? How does it differ from a physical card? And why should you consider adding a virtual card to Apple Wallet? In this article, we’ll delve into these questions and more, giving you a comprehensive understanding of virtual cards and their benefits.

A virtual card, as the name suggests, is a digital representation of a physical card. It carries all the necessary card details, such as the card number, expiration date, and security code, in an electronic format. The primary difference is that instead of a physical piece of plastic, a virtual card exists solely in the digital realm.

There are several advantages to adding a virtual card to Apple Wallet. First and foremost, it declutters your physical wallet. Instead of carrying multiple cards, you can store all your virtual cards in one place on your iPhone or Apple Watch.

Additionally, virtual cards offer increased security. With a physical card, the risk of it being lost or stolen is always present. On the other hand, virtual cards are protected by encryption and can be instantly deactivated or locked if necessary. This provides peace of mind knowing that your card information is secure.

Virtual cards also offer greater versatility. They can be used for online purchases, in-app transactions, and even at contactless payment terminals using Apple Pay. Whether you’re shopping online or making a quick purchase at a physical store, having a virtual card in your Apple Wallet ensures that you’re ready to make a payment.

Now that you understand the benefits of virtual cards, let’s explore the supported virtual card providers and learn how to add a virtual card to Apple Wallet. Whether you have a credit card, debit card, or a prepaid card, you’ll soon discover how easy and convenient it is to go digital with your payments.

What is a Virtual Card?

A virtual card, also known as a digital card or e-card, is a form of payment card that exists in a digital format rather than as a physical card. It functions just like a traditional credit or debit card, allowing you to make purchases online or in-person, but without the need for a physical card.

Virtual cards are issued by financial institutions or payment providers and are typically linked to your existing credit or debit card. They are designed to be used for specific transactions or for a limited time, providing an added layer of security and flexibility.

When you use a virtual card for online or mobile purchases, the card number, expiration date, and security code are securely stored in digital form. This information can be accessed through a mobile wallet application, such as Apple Wallet. Virtual cards can also be used for contactless payments by linking them to mobile payment services like Apple Pay.

One of the key advantages of virtual cards is their enhanced security. Since they don’t physically exist, the risk of them being lost or stolen is greatly reduced. Additionally, virtual cards often come with additional security features such as dynamic card numbers. This means that each time you make a purchase, a unique card number is generated, adding an extra layer of protection against fraud.

Another benefit of virtual cards is their convenience. With a virtual card in your Apple Wallet, you can easily manage multiple cards in one place, without the need to carry a physical wallet full of cards. This is especially useful when traveling, as you can leave your physical cards securely stored at home and use only your virtual cards for payments.

Virtual cards are also ideal for online shopping, as they eliminate the need to manually enter card details for each transaction. With just a few taps on your device, you can securely complete your purchase without exposing your actual card information to potential risks.

Overall, virtual cards offer a secure and convenient way to make payments in the digital age. By understanding what virtual cards are and how they work, you can take advantage of this modern payment solution and streamline your financial transactions.

Benefits of Adding a Virtual Card to Apple Wallet

Adding a virtual card to Apple Wallet offers a range of benefits that can greatly enhance your payment experience and provide added convenience and security. Let’s explore some of the key advantages:

1. Streamlined Payment Management: With Apple Wallet, you can store multiple virtual cards in one place on your iPhone or Apple Watch. This eliminates the need to carry physical cards and allows for easy access to your cards whenever you need them. Whether it’s a credit card, debit card, or prepaid card, you can have all your payment options readily available at your fingertips.

2. Enhanced Security: Virtual cards in Apple Wallet offer an extra layer of security. Your card details are securely encrypted and stored on your device, reducing the risk of your information being compromised. In addition, Apple employs advanced security measures like Face ID or Touch ID to authorize transactions, ensuring that only you can access and use your virtual cards.

3. Contactless Payments: By adding a virtual card to Apple Wallet, you can make contactless payments using Apple Pay. Simply hold your iPhone or Apple Watch near a contactless payment terminal, authenticate your purchase, and you’re good to go. This provides a convenient and hygienic way to pay, without the need to swipe or insert a physical card.

4. Compatibility with Online and In-App Purchases: Virtual cards in Apple Wallet can be used for online and in-app purchases. When making a transaction on a website or within a mobile app, you can choose to pay with your virtual card and complete the purchase securely. This eliminates the need to manually enter your card details for each transaction, saving you time and reducing the risk of exposing your card information.

5. Real-Time Notifications and Transaction History: When you use a virtual card in Apple Wallet, you receive real-time notifications for each transaction, providing you with an instant record of your spending. You can also view a transaction history within the Wallet app, giving you better visibility and control over your finances.

6. Versatile Usage: Virtual cards in Apple Wallet can be used not only for payments but also for other purposes. For example, you can store boarding passes, event tickets, or loyalty cards in your Wallet, further reducing the need to carry physical items.

By adding a virtual card to Apple Wallet, you can enjoy the convenience, security, and versatility of digital payments. With just a few taps, you can make purchases in-store, online, or within mobile apps, all while keeping your card information secure and easily accessible. It’s a modern solution that simplifies your payment experience and transforms your iPhone or Apple Watch into a powerful digital wallet.

Supported Virtual Card Providers

Apple Wallet supports a wide range of virtual card providers, allowing you to add various types of virtual cards to your digital wallet. Whether you have a credit card, debit card, or prepaid card, there is a good chance that it can be added to Apple Wallet. Here are some of the popular virtual card providers compatible with Apple Wallet:

- Major Credit Card Companies: Virtually all major credit card companies, including Visa, Mastercard, American Express, and Discover, support virtual cards in Apple Wallet. If you have a credit card from any of these companies, you should be able to add it to your Apple Wallet and enjoy the benefits of a virtual card.

- Banks and Financial Institutions: Many banks and financial institutions also offer virtual cards that can be added to Apple Wallet. Whether you have a checking account, a savings account, or a prepaid card linked to your bank, check if your bank supports virtual card integration with Apple Wallet.

- Payment Service Providers: Popular payment service providers like PayPal and Venmo also offer virtual cards that are compatible with Apple Wallet. These virtual cards are linked to your PayPal or Venmo account and can be used for online and in-app purchases, as well as contactless payments using Apple Pay.

- Retailers and Merchants: In addition to credit cards and banks, certain retailers and merchants offer virtual cards for ease of use. For example, some online marketplaces or subscription-based services provide virtual cards that can be added to Apple Wallet, enabling you to make purchases from their platform seamlessly.

- Mobile Network Providers: Some mobile network providers have their virtual card offerings that can be integrated with Apple Wallet. These virtual cards are often used for mobile payments, allowing you to conveniently pay for services like phone bills or add credit to your mobile account.

It’s important to note that the availability of virtual card integration may vary depending on your location and the specific terms and conditions set by the card provider or financial institution. To confirm whether your virtual card is supported by Apple Wallet, you can check with the card issuer, visit their website, or consult Apple’s official compatibility list.

By taking advantage of the wide range of supported virtual card providers, you can add your preferred payment options to your Apple Wallet and enjoy the convenience of digital payments.

Steps to Add a Virtual Card to Apple Wallet

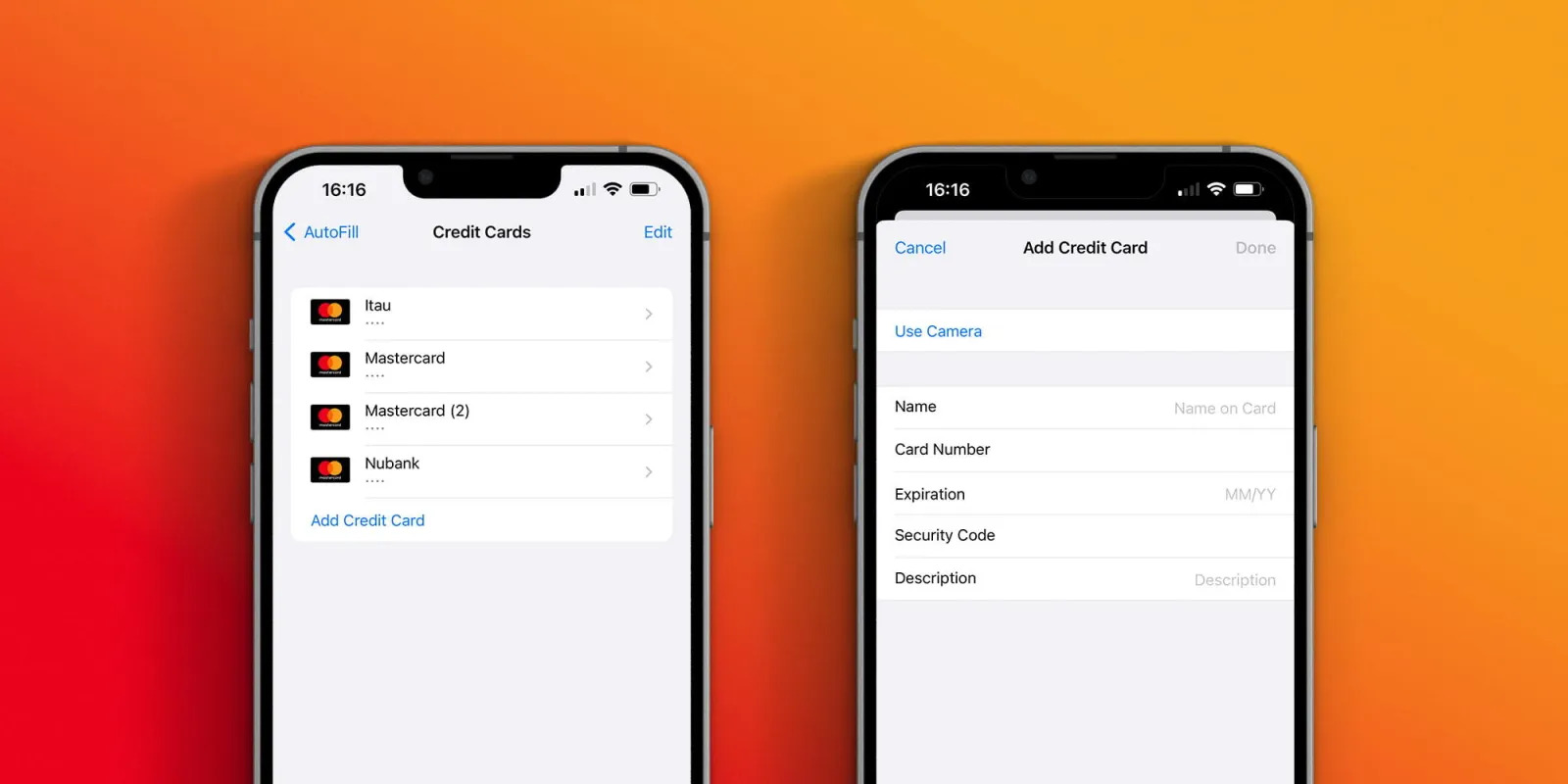

Adding a virtual card to Apple Wallet is a straightforward process that can be done in just a few simple steps. Whether you’re adding a credit card, debit card, or prepaid card, here’s a general guide on how to add a virtual card to Apple Wallet:

- Open the Wallet App: Locate and open the Wallet app on your iPhone or Apple Watch. This app is pre-installed on iOS devices and is represented by a wallet icon.

- Tap the “+” Button: Look for the “+” button, usually located in the top-right corner of the Wallet app. Tap on it to begin the process of adding a card.

- Select the Card Type: You’ll be presented with different card options, such as Credit Card, Debit Card, or Prepaid Card. Choose the appropriate card type for your virtual card.

- Enter Card Details: Follow the on-screen prompts to enter the required card details. This typically includes the card number, expiration date, and security code. You may also need to provide additional information, such as your name and billing address.

- Authenticate the Card: Depending on your device’s security settings, you may be prompted to authenticate the card using methods such as Face ID, Touch ID, or your device passcode. This adds an extra layer of security to ensure that only you can add cards to Apple Wallet.

- Confirm and Verify: Once you’ve entered all the necessary information, review the details to ensure accuracy. Make sure the card information matches your virtual card and that there are no typos or errors.

- Agree to Terms and Conditions: You may be required to agree to the terms and conditions of the virtual card provider or financial institution. Read through the terms and conditions, and if you agree, select the appropriate option to proceed.

- Verification: In some cases, card verification may be necessary. This can be done through various methods, such as receiving a verification code via SMS or email and entering it into the Wallet app.

- Card Activation: Once the card is added to Apple Wallet, you may need to activate it. This can be done through the virtual card provider’s website, mobile app, or by following any additional instructions provided.

- Ready to Use: After successfully adding and activating the virtual card, it will be available for use within Apple Wallet. You can now use your virtual card for payments, both online and at contactless payment terminals.

Note that the specific steps may vary slightly depending on the virtual card provider and your device’s operating system version. It’s recommended to refer to the instructions provided by the virtual card provider or consult Apple’s support documentation for any specific guidance related to adding virtual cards to Apple Wallet.

By following these steps, you’ll be able to seamlessly add your virtual cards to Apple Wallet and enjoy the convenience of mobile payments and digital transactions.

Troubleshooting Tips

While adding a virtual card to Apple Wallet is usually a smooth process, there may be instances where you encounter some difficulties or issues. Here are some troubleshooting tips to help you resolve common problems that may arise:

1. Card Not Supported: If you receive a message stating that your virtual card is not supported by Apple Wallet, double-check that the card provider or financial institution is indeed compatible. Reach out to the card issuer for further assistance or to inquire about any specific requirements for adding the virtual card to Apple Wallet.

2. Incorrect Card Information: Make sure you carefully enter the card details, including the card number, expiration date, and security code. Even a small typo can result in an error. Verify the information provided by referring to the physical card or contacting the card provider directly for accurate details.

3. Security Authentication Failure: If you’re unable to authenticate the card using Face ID, Touch ID, or your device passcode, ensure that the settings for these authentication methods are properly configured. You may need to update your device’s software or reconfigure the authentication settings to resolve any issues.

4. Verification Code Not Received: If you’re prompted to verify your virtual card but haven’t received a verification code via SMS or email, check your spam or junk folder to ensure it hasn’t been filtered there. Alternatively, contact the virtual card provider to request the code be resent or inquire about alternative verification methods.

5. Activation Failure: If you encounter difficulties in activating the virtual card after adding it to Apple Wallet, visit the virtual card provider’s website or mobile app for activation instructions. In some cases, you may need to contact customer support for further assistance.

6. Card Declined: If your virtual card is being declined when attempting a transaction, ensure that you have sufficient funds available or resolve any outstanding issues with your virtual card provider. You may need to contact customer support to investigate and address any potential issues.

7. Updating Card Information: If there are changes to your virtual card information, such as a new expiration date or security code, make sure to update the card details in Apple Wallet. This can typically be done by editing the card within the Wallet app and entering the updated information.

8. Contact Apple Support: If you’ve exhausted all troubleshooting options and are still experiencing issues, reach out to Apple Support for further assistance. They can provide guidance specific to your device, operating system version, and any potential software or compatibility issues.

Remember, each virtual card provider may have unique troubleshooting steps or requirements, so it’s always a good idea to consult their support resources or contact their customer service directly for individual assistance.

By following these troubleshooting tips, you can overcome potential hurdles and ensure a smooth experience when adding and using virtual cards in Apple Wallet.

Conclusion

In conclusion, adding a virtual card to Apple Wallet brings numerous benefits to your payment experience. By using virtual cards, you can streamline your wallet, enhance security, and enjoy the convenience of digital payments.

Virtual cards offer the advantage of decluttering your physical wallet by allowing you to store multiple cards in one place on your iPhone or Apple Watch. This eliminates the need to carry numerous cards and simplifies payment management.

With enhanced security measures, virtual cards in Apple Wallet provide an extra layer of protection for your card information. Encryption, biometric authentication, and dynamic card numbers help to ensure that your transactions are secure and your personal data is not compromised.

You can use virtual cards for contactless payments through Apple Pay, making transactions quick, convenient, and hygienic. Whether you’re shopping online or making in-app purchases, virtual cards in Apple Wallet offer versatility and ease of use.

Supported by a wide range of virtual card providers, including major credit card companies, banks, payment service providers, retailers, and mobile network providers, you have various options to choose from when adding a virtual card to Apple Wallet.

By following the simple steps outlined in this article, you can seamlessly add your virtual cards to Apple Wallet and take advantage of the benefits they offer. And in the event that you encounter any issues, the provided troubleshooting tips can help you resolve problems and ensure a smooth experience.

With virtual cards in Apple Wallet, you have the power of digital payments at your fingertips. Say goodbye to the hassle of carrying multiple physical cards and welcome the convenience and security of managing your payments with ease.

So go ahead, explore the world of virtual cards, and embrace the future of payment technology with Apple Wallet.