How To Pay In China As A Tourist

Introduction

China is a vibrant and diverse country, attracting millions of tourists each year with its rich history, stunning landscapes, and bustling cities. When visiting China as a tourist, it’s essential to understand the different payment methods available to ensure a smooth and convenient experience. In recent years, China has become increasingly cashless, with mobile payment systems dominating the market. However, cash is still widely accepted, especially in smaller establishments and rural areas.

In this article, we will explore the various payment methods in China, including cash, mobile payments like WeChat Pay and Alipay, UnionPay, credit cards, and currency exchange. We will also provide helpful tips for safe and convenient payments while traveling in China.

Understanding the payment landscape in China is crucial for tourists to navigate daily expenses, such as accommodation, transportation, dining, and shopping. Whether you’re exploring the historic wonders of Beijing, marveling at the modern skyscrapers in Shanghai, or immersing yourself in the picturesque landscapes of Guilin, having the right payment options at your disposal will greatly enhance your travel experience.

It’s important to note that while some payment methods are widely accepted nationwide, others may be more prevalent in specific regions or establishments. It’s always a good idea to have multiple payment options available to ensure you’re prepared for any situation.

So, let’s dive into the fascinating world of payment methods in China and discover how you can conveniently pay during your visit to this incredible country.

Overview of Payment Methods in China

China has rapidly evolved into a cashless society, with mobile payment systems leading the way. While cash is still accepted in many places, mobile payments have become the preferred method for both locals and tourists. The two most popular mobile payment platforms in China are WeChat Pay and Alipay, which are used for a wide range of transactions, from small street vendors to large shopping centers.

In addition to mobile payments, UnionPay is another widely accepted payment method in China. It is the country’s national bank card association and operates both debit and credit card services. UnionPay cards are accepted at most establishments, making it a convenient option for travelers.

Furthermore, credit cards, particularly those issued by major international companies like Visa and Mastercard, are also accepted at many hotels, department stores, and high-end restaurants in major cities. However, it’s important to note that credit card acceptance may be more limited in smaller towns or rural areas.

Lastly, cash is still widely accepted and necessary for certain transactions, especially in local markets, small eateries, and transportation options like taxis and buses. It’s always recommended to carry some cash on hand for these situations.

Now that we have a general overview of the payment methods in China, let’s delve deeper into each option, starting with cash payments.

Cash Payment

While China is gradually becoming a cashless society, cash still plays a significant role in everyday transactions, particularly in smaller establishments, local markets, and rural areas. Carrying some cash is essential for situations where mobile payment or card options may not be available.

Chinese currency is called the Renminbi (RMB), and the basic unit is the Yuan (CNY). The most commonly used banknotes are 100 yuan, 50 yuan, 20 yuan, 10 yuan, and 1 yuan. In addition, there are smaller denominations of coins, such as 1 yuan, 0.5 yuan, 0.1 yuan, and 0.01 yuan.

When using cash for payments, it’s important to have small denominations on hand, as many smaller establishments may not be able to provide change for larger bills. It’s also a good idea to carry a mix of cash denominations to cover various expenses throughout the day.

One convenient way to obtain cash in China is through Automated Teller Machines (ATMs). ATMs are widely available in all major cities and most tourist areas. Major international cards such as Visa, Mastercard, and UnionPay are accepted at ATMs, allowing you to withdraw cash in Chinese currency.

It’s worth noting that while cash is accepted in many places, some larger establishments, such as upscale hotels, restaurants, and shopping malls, may prefer or require alternative payment methods like mobile payments or credit cards. Therefore, it’s always a good idea to have multiple payment options available when traveling in China.

Now that we have covered cash payments, let’s explore the world of mobile payments in China, starting with WeChat Pay.

Mobile Payment

Mobile payment has revolutionized the way transactions are made in China, with cashless methods quickly gaining popularity across the country. WeChat Pay and Alipay, two leading mobile payment platforms, have become ubiquitous in daily life, making it incredibly convenient for locals and travelers alike.

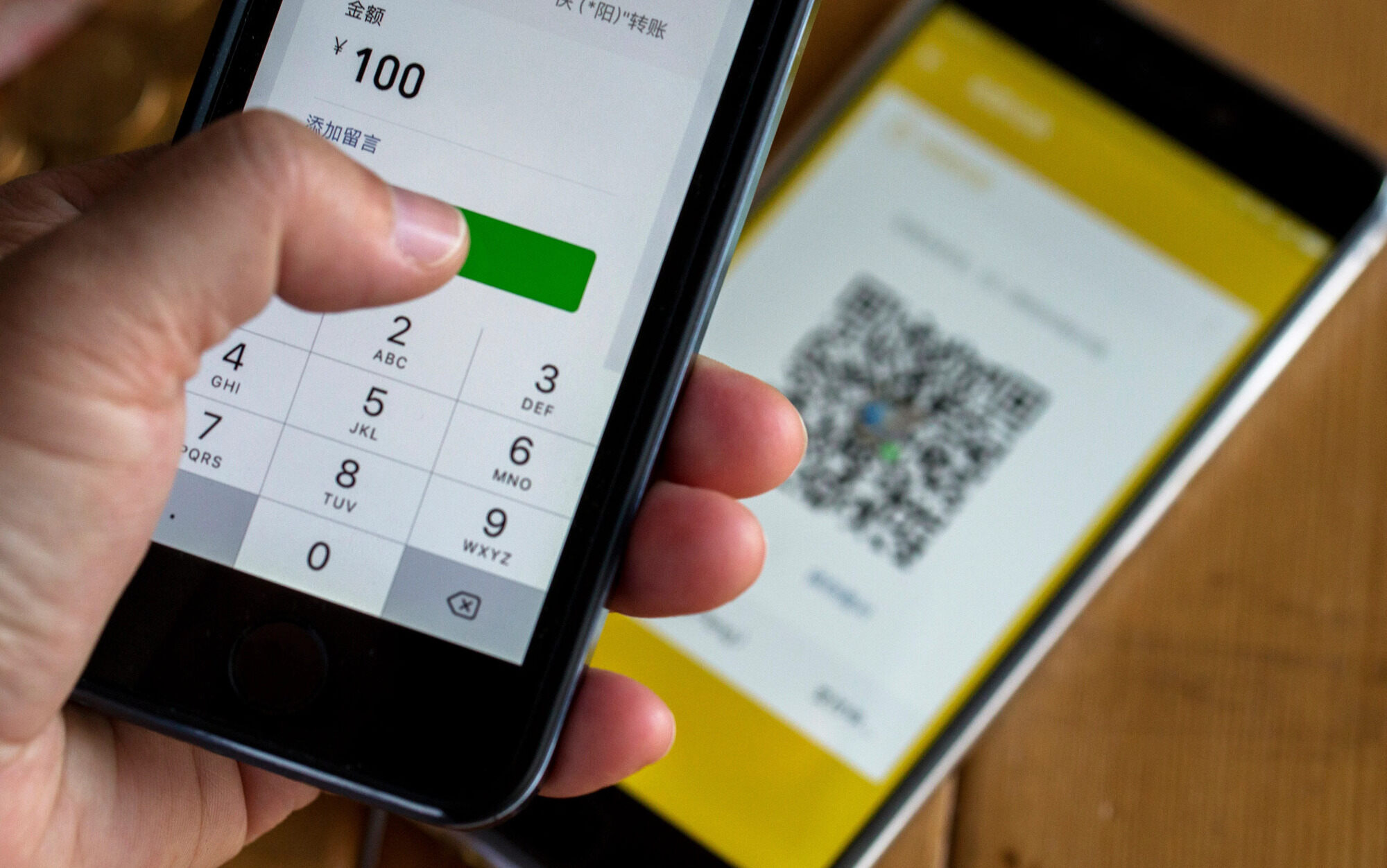

WeChat Pay: Developed by Tencent, WeChat Pay is integrated into the immensely popular messaging app WeChat, which boasts over a billion active users. To use WeChat Pay, you’ll need to link your bank account or credit card to your WeChat account. Once set up, you can make payments by scanning QR codes displayed at participating stores, restaurants, and even street vendors. WeChat Pay also supports peer-to-peer transfers, allowing you to easily send money to friends and family. It’s important to note that you need a Chinese bank account to fully utilize WeChat Pay’s features as a tourist.

Alipay: Created by Ant Group, Alipay is another prominent mobile payment platform widely used in China. Similar to WeChat Pay, Alipay enables users to link their bank accounts or credit cards and make payments by scanning QR codes. Alipay also offers features such as utility bill payments, ride-hailing services, and the ability to invest in wealth management products. As a tourist, you can create an Alipay account using your foreign mobile number, but certain features may be limited without a Chinese bank account.

Both WeChat Pay and Alipay are widely accepted throughout China, from major chain stores to small local businesses. The ease and convenience of mobile payments mean you can leave your wallet at home and rely solely on your smartphone for financial transactions.

It’s important to note that while WeChat Pay and Alipay dominate the mobile payment landscape, some establishments may only accept one of these platforms. However, this is becoming less common as more businesses now accept both. To ensure you’re ready for any situation, it’s advisable to have both WeChat Pay and Alipay set up on your smartphone.

Next, let’s explore another popular payment method in China: UnionPay.

WeChat Pay

WeChat Pay is a mobile payment platform developed by Tencent, integrated into the immensely popular messaging app WeChat. With over a billion active users, WeChat Pay has become a dominant force in the cashless payment landscape of China.

To utilize WeChat Pay, you need to link your bank account or credit card to your WeChat account. Once set up, you can make payments by simply scanning QR codes displayed at participating stores, restaurants, and even street vendors. The convenience and ease of this payment method have made it extremely popular among both locals and tourists in China.

One of the key features of WeChat Pay is its seamless integration into the WeChat app. Apart from making payments, you can also use WeChat Pay to transfer money to friends and family, pay utility bills, top up mobile phone credit, make online purchases, and even book train and flight tickets – all within the WeChat ecosystem.

As a tourist, it’s important to note that to fully utilize WeChat Pay’s features, you would typically need a Chinese bank account. However, there are still ways for tourists to use WeChat Pay without a Chinese bank account. You can opt to link a foreign credit card to your WeChat account, which allows you to make payments at most establishments accepting WeChat Pay. Keep in mind that some features may be limited or unavailable without a Chinese bank account.

WeChat Pay has gained widespread acceptance across China, and it is now commonly used in various settings, including shopping malls, restaurants, supermarkets, and even public transportation. You can also use it to split bills with friends, as WeChat Pay allows for easy peer-to-peer transfers between users.

To start using WeChat Pay as a tourist, all you need to do is download the WeChat app on your smartphone, create an account, and follow the prompts to set up WeChat Pay. It’s a convenient and secure payment method that eliminates the need to carry cash or credit cards during your travels in China.

Now that we have explored WeChat Pay, let’s move on to another widely-used mobile payment option: Alipay.

Alipay

Alipay, developed by Ant Group, is another popular mobile payment platform in China that has gained significant traction in recent years. It offers seamless and convenient payment options for both locals and travelers alike.

Similar to WeChat Pay, Alipay allows users to link their bank accounts or credit cards to their Alipay account. Once set up, you can make payments by scanning QR codes at participating stores, restaurants, and other businesses. Alipay also offers a wide range of additional services, including bill payments, wealth management, food delivery, ride-hailing, and even booking flights and hotels.

One advantage of Alipay is that as a tourist, you can create an account using your foreign mobile number. This allows you to access certain features and make payments at establishments that accept Alipay. However, it’s important to note that without a Chinese bank account, certain functionalities may be limited.

Alipay has a vast network of partner merchants, ranging from large international retail chains to local vendors. The platform is widely accepted in many establishments across China, including shopping centers, convenience stores, restaurants, and tourist attractions. Moreover, Alipay’s international partner network expands its usability beyond China, allowing you to make payments in select overseas locations as well.

Like WeChat Pay, Alipay offers a secure and efficient payment experience. Transactions are protected by advanced encryption and authentication technologies, providing peace of mind for users. Additionally, Alipay’s user-friendly interface and seamless integration with other services make it a convenient tool for managing financial transactions while traveling in China.

To start using Alipay, you need to download the Alipay app on your smartphone and follow the prompts to create an account. Once set up, you can easily link your bank account or credit card to start making payments. It’s recommended to have Alipay installed alongside WeChat Pay, as some establishments may only accept one of these mobile payment platforms.

Now that we have explored the world of mobile payments, let’s move on to another widely-used payment option in China: UnionPay.

UnionPay

UnionPay is China’s national bank card association, offering both debit and credit card services. It has gained prominence as a widely accepted payment method in China, making it convenient for both locals and tourists.

With UnionPay, you can use your debit or credit card to make payments at various establishments, including hotels, restaurants, shopping centers, and tourist attractions. UnionPay cards are accepted by most merchants in China, especially in urban areas and popular tourist destinations.

To use UnionPay, you simply need to swipe or insert your card into the point-of-sale (POS) terminal and enter your PIN for verification. It’s important to note that while UnionPay is widely accepted, some smaller establishments may only accept cash or mobile payments, so it’s always a good idea to have alternative payment methods available.

UnionPay cards are issued by many major banks in China as well as international institutions. If you already have a UnionPay card from your home country, it’s likely to be accepted at most POS terminals in China. However, it’s advisable to inform your bank about your travel plans to ensure that your card will work seamlessly during your stay.

In addition to being accepted domestically, UnionPay cards can also be used for international transactions. This makes it convenient for tourists who want to withdraw cash at ATMs or make card payments while traveling in China.

When using UnionPay, it’s important to keep an eye out for any transaction fees or foreign exchange charges that may apply. Some banks may charge a fee for international transactions, so it’s wise to inquire about these fees in advance.

Overall, UnionPay provides a reliable and widely accepted payment method in China. It offers the convenience and security of card payments, making it a convenient option for travelers who prefer not to rely solely on cash or mobile payment platforms like WeChat Pay and Alipay.

Now that we have covered UnionPay, let’s move on to another popular payment option for tourists in China: credit cards.

Credit Cards

Credit cards are widely accepted in major cities and tourist areas in China, making them a convenient payment option for travelers. International credit card networks such as Visa, Mastercard, American Express, and JCB are commonly accepted by many businesses, including hotels, restaurants, department stores, and upscale shopping centers.

Using a credit card in China works similarly to other countries. You can present your card at the point of sale (POS) terminal, and in most cases, you will be prompted to enter your PIN or provide a signature for verification. Some establishments may also support contactless payment technology, allowing you to make quick and easy transactions by tapping your card on the terminal.

It’s important to note that while credit cards are widely accepted, there may be instances where smaller establishments or businesses in rural areas may prefer or only accept cash or mobile payments. Therefore, it’s advisable to have alternative payment methods on hand, such as cash or mobile payment apps like WeChat Pay or Alipay.

When using credit cards in China, it’s essential to keep a few things in mind. Firstly, it’s recommended to inform your credit card issuer about your travel plans to ensure uninterrupted service during your stay. Secondly, be cautious when using your credit card for online purchases or at unfamiliar establishments to protect against potential fraud. Lastly, be aware of any foreign transaction fees or currency conversion charges that may apply when using your credit card in China.

While credit cards are a convenient payment option, it’s advisable to carry some cash or have a backup payment method available, as there may still be instances where credit card acceptance is limited. Having a mix of payment options will ensure you’re prepared for any situation and can enjoy a hassle-free payment experience during your travels in China.

Now that we’ve covered the various payment methods in China, let’s move on to discussing currency exchange and tips for safe and convenient payments.

Currency Exchange

When traveling to China, it’s important to consider currency exchange to ensure you have the local currency, Renminbi (RMB), for your transactions. Here are some essential things to know about currency exchange in China.

1. Exchange Currency Before Arrival: It’s advisable to exchange a small amount of Chinese currency before arriving in China. This will give you some local cash for immediate expenses like transportation or small purchases upon arrival.

2. ATMs: Automated Teller Machines (ATMs) are widely available in China, especially in major cities and tourist areas. ATMs allow you to withdraw cash in Chinese currency using your debit or credit card. Make sure to check with your bank about any international transaction fees or ATM withdrawal limits that may apply.

3. Bank Currency Exchange: Banks in China offer currency exchange services. It’s recommended to exchange currency at banks authorized for this service, as they generally offer competitive rates and a reliable exchange process. Avoid exchanging money with street vendors or unauthorized businesses to ensure the validity of the currency.

4. Hotels and Airports: Many hotels and airports in China have currency exchange counters where you can change your money. However, be aware that rates may not be as favorable as those offered by banks.

5. Currency Restrictions: Chinese regulations limit the amount of foreign currency that can be exchanged. It’s important to familiarize yourself with these restrictions to avoid any inconvenience.

6. Keep Receipts: It’s essential to keep the official currency exchange receipts. This will help you convert any unused Chinese currency back to your home currency upon departure.

7. Alternative Payment Methods: While it’s essential to have some Chinese currency on hand, it’s worth noting that mobile payment platforms like WeChat Pay and Alipay are widely accepted. These platforms allow you to link your bank account or credit card and make convenient electronic payments.

By considering these currency exchange options, you can ensure that you have the necessary local currency for your expenses while traveling in China. Having a mix of cash and digital payment options will provide you with flexibility and convenience during your stay.

Next, let’s move on to some tips for safe and convenient payments in China.

Tips for Safe and Convenient Payments in China

When it comes to making payments in China, it’s important to keep a few tips in mind to ensure a safe and convenient experience. Here are some helpful suggestions:

1. Carry a Mix of Payment Methods: To be prepared for any situation, it’s advisable to have a variety of payment options available. Carry some cash for smaller establishments that may not accept cards or mobile payments, and have mobile payment apps like WeChat Pay and Alipay installed on your smartphone for convenient and widespread acceptance.

2. Protect Personal Information: Be cautious when providing personal information while making payments. Ensure you are using secure networks and avoid sharing sensitive information with unknown sources or over unsecured Wi-Fi connections.

3. Monitor Exchange Rates: If you’re exchanging currency, keep an eye on the exchange rates to ensure you get a fair deal. Compare rates offered by banks, hotels, and exchange counters to find the most favorable rate.

4. Stay Alert for Scams: Unfortunately, scams exist in any destination, and China is no exception. Be cautious when approached by strangers offering deals or discounts that seem too good to be true. Stick to reputable establishments and use official channels for payments.

5. Notify Your Bank: Before traveling to China, inform your bank about your travel plans. This will ensure your debit or credit card is not flagged for suspicious activity and prevent any disruptions in card usage.

6. Keep an Eye on Your Belongings: Pickpocketing can happen in crowded areas, so be mindful of your belongings. Keep your wallet, phone, and other valuable items secure and close to you when making payments.

7. Learn Basic Chinese Phrases: While many establishments in major cities have English signage and staff who speak English, it can still be helpful to learn a few basic Chinese phrases or carry a translation app. This can aid communication during payment transactions and make the process smoother.

By following these tips, you can ensure safe and convenient payments while traveling in China. Whether you’re enjoying the vibrant streets of Beijing, exploring the ancient wonders of Xi’an, or immersing yourself in the bustling markets of Shanghai, having a reliable payment strategy will enhance your overall travel experience.

Now let’s discuss some concluding remarks.

Conclusion

China offers a wide range of payment methods to cater to the needs of both locals and tourists. From traditional cash payments to the convenience of mobile payment platforms like WeChat Pay and Alipay, as well as the widespread acceptance of UnionPay and credit cards, travelers have various options to make their payments in China.

With the increasing popularity of mobile payments, carrying a mix of cash and having mobile payment apps installed on your smartphone is recommended. This ensures that you are prepared for any situation, whether you’re exploring bustling cities or venturing into remote areas.

It’s important to note that while mobile payments dominate the market, cash is often still necessary for certain transactions, especially in smaller establishments and rural areas. Having smaller denominations and a mix of cash denominations will ensure you’re prepared for these situations.

When it comes to currency exchange, it’s advisable to exchange a small amount of Chinese currency before arrival and use ATMs or authorized exchange counters to obtain more as needed. Keeping track of exchange rates and understanding any restrictions or fees associated with currency exchange will help you make informed decisions throughout your trip.

To ensure safe and convenient payments in China, it’s crucial to protect your personal information, stay alert for scams, and notify your bank of your travel plans. Being vigilant about your belongings and learning some basic Chinese phrases can also enhance your payment experience and communication with vendors.

By familiarizing yourself with the available payment methods, understanding the nuances of each option, and following the tips provided, you can navigate the payment landscape in China with ease and confidence.

So whether you’re marveling at the Great Wall, exploring the breathtaking landscapes of Zhangjiajie, or indulging in delectable local cuisine, you can focus on creating lasting memories while having a convenient and secure payment experience in China.