How Do I Use Paypal Wallet

Introduction

Welcome to the world of PayPal Wallet, the convenient and secure way to manage your finances online. Whether you’re making online purchases, sending money to friends and family, or receiving payments for your products or services, PayPal Wallet has you covered.

With the increasing popularity of online shopping and digital transactions, having a reliable and user-friendly payment method is essential. PayPal Wallet offers a wide range of features and benefits that make it one of the most trusted and widely used digital wallets worldwide.

In this comprehensive guide, we will walk you through the process of setting up and using PayPal Wallet, step by step. From creating an account to managing your balance, sending and requesting money, making online purchases, and more, we’ll cover everything you need to know to make the most of this powerful financial tool.

But before we dive in, let’s take a moment to understand what PayPal Wallet is and why it’s a preferred choice for millions of individuals and businesses alike.

At its core, PayPal Wallet is an online platform that allows you to link your bank account, credit or debit cards, and other financial instruments to make seamless and secure transactions. It acts as a digital wallet, enabling you to store funds and make payments without the need to share sensitive financial information with sellers or recipients.

One of the standout features of PayPal Wallet is its strong emphasis on security. With advanced encryption protocols, fraud protection, and buyer and seller protection policies, PayPal Wallet provides users with peace of mind when it comes to their financial transactions.

Moreover, PayPal Wallet has gained widespread acceptance among online merchants, making it a globally recognized payment method. It has become a default option on many e-commerce platforms and offers a streamlined checkout process, allowing you to complete your purchases with just a few clicks.

In the following sections, we will guide you through the process of creating and verifying your PayPal account, as well as provide detailed instructions on how to use PayPal Wallet for various transactions. Whether you’re a seasoned user looking to delve deeper into the features or a newcomer seeking guidance, this guide has got you covered.

So, let’s get started on your PayPal Wallet journey and discover the endless possibilities it brings to your online financial management.

Creating a PayPal Account

Before you can start using PayPal Wallet, you’ll need to create an account. The process is simple and straightforward, and you’ll be up and running in no time. Here’s a step-by-step guide:

- Go to the PayPal website or download the PayPal app from your mobile device’s app store.

- Click on the “Sign Up” or “Create an Account” button.

- Select the type of account you want to create – Personal or Business. If you’re an individual looking to make online purchases and send/receive money from friends and family, select “Personal Account.” If you’re a business owner or plan to use PayPal for business purposes, select “Business Account.”

- Provide your email address and create a strong, unique password for your PayPal account.

- Fill in your personal information, such as your name, address, and phone number. Make sure the information you provide is accurate and up to date. This will help in verifying your account and enhancing security.

- Agree to the terms of service and privacy policy of PayPal.

- Click on the “Agree and Create Account” or similar button to create your PayPal account.

- You will then receive a verification email from PayPal. Check your inbox and click on the verification link provided to confirm your email address. If you don’t see the email in your inbox, make sure to check your spam or junk folder.

Once you’ve completed these steps, your PayPal account will be created, and you can start using PayPal Wallet to manage your online transactions.

Creating a PayPal account is free, and you can upgrade or downgrade your account type at any time based on your needs. It’s important to note that PayPal may require additional verification information, such as your Social Security Number or National Identification Number, depending on your region and the type of account you choose.

Keep your PayPal account credentials secure and don’t share them with anyone. This will help prevent unauthorized access to your account and protect your financial information.

Now that you have successfully created your PayPal account, let’s move on to the next step – linking your bank account to your PayPal Wallet.

Linking Your Bank Account

Linking your bank account to your PayPal Wallet is an important step that allows you to easily transfer funds between your bank and your PayPal account. It also enables you to withdraw funds from your PayPal balance to your bank account. Here’s how you can link your bank account:

- Log in to your PayPal account using your email address and password.

- Click on the “Wallet” tab, usually located at the top of the page.

- Select “Link a Bank Account” or a similar option.

- Choose your bank from the list of options provided, or click “I have a different bank” if your bank is not listed.

- Enter the required bank account information, including your account number and routing number. You can usually find these details on your checks or by contacting your bank.

- Review the information you provided and ensure it is accurate.

- Click “Link Bank Account” or a similar button to proceed.

Once you’ve completed these steps, PayPal will initiate the process of linking your bank account to your PayPal Wallet. This process may take a few business days to complete, as PayPal verifies the information provided and establishes a secure connection with your bank.

During the verification process, PayPal may make two small deposits into your bank account, typically less than $1. These deposits serve as a confirmation that you have access to the bank account you want to link. You can check your bank statement or online banking portal to find the exact amounts of these deposits.

Once you have the deposit amounts, log in to your PayPal account and navigate to the “Wallet” tab. Click on the bank account you wish to verify and enter the deposit amounts in the designated field. This step completes the verification process and confirms that you are the owner of the bank account.

Once your bank account is successfully linked and verified, you’ll be able to transfer funds between your bank and PayPal account with ease. You can also set your bank account as the default funding source for your PayPal transactions, ensuring a smooth payment process when using PayPal to make online purchases or send money to others.

By linking your bank account to your PayPal Wallet, you can enjoy seamless financial management and access to your funds whenever needed. It’s important to note that PayPal may charge fees for certain transactions, such as withdrawing funds to your bank account. Be sure to review PayPal’s fee structure and policies to stay informed about any associated costs.

Next, we will explore how to add a credit or debit card to your PayPal Wallet for additional payment options.

Adding a Credit or Debit Card

In addition to linking your bank account, you can add a credit or debit card to your PayPal Wallet. This gives you another convenient and secure option for making online payments and transactions. Here’s how you can add a credit or debit card to your PayPal account:

- Log in to your PayPal account using your email address and password.

- Click on the “Wallet” tab, usually located at the top of the page.

- Select “Link a Credit or Debit Card” or a similar option.

- Enter the required card information, including the card number, expiration date, and security code (CVV).

- Provide the billing address associated with the card. Make sure it matches the address on file with your card issuer.

- Review the information you entered and ensure it is accurate.

- Click “Link Card” or a similar button to add the card to your PayPal Wallet.

Once you’ve completed these steps, PayPal will verify the card information provided and establish a secure connection with your card issuer. This verification process is essential for ensuring the security of your transactions.

If your card is successfully added and verified, it will now be available as a payment option when making purchases through PayPal. You can also set your credit or debit card as your preferred funding source for PayPal transactions, allowing for a smooth and seamless payment experience.

When using a credit card for your PayPal transactions, keep in mind that certain fees may apply, such as transaction fees or foreign exchange fees for international purchases. Be sure to review PayPal’s fee structure and policies to stay informed about any associated costs.

Having a credit or debit card linked to your PayPal Wallet provides you with added flexibility and convenience when it comes to managing your finances online. You can easily switch between payment methods or choose different cards depending on your preference or the specific transaction.

In addition to adding a credit or debit card, you can also add multiple cards to your PayPal account. This can be beneficial if you prefer to use different cards for different types of purchases or to separate personal and business expenses.

With your bank account and credit or debit card linked to your PayPal Wallet, you now have various options for managing your finances, making payments, and sending money to others. In the next section, we will explore the process of verifying your PayPal account to unlock additional features.

Verifying Your Account

To fully unlock the features and benefits of PayPal Wallet, it’s important to verify your account. Verifying your account adds an extra layer of security and increases your account limits, allowing you to make larger transactions and enjoy a greater level of trust with PayPal. Here’s how you can verify your PayPal account:

- Log in to your PayPal account using your email address and password.

- Click on the “Settings” or “Profile” tab, usually located at the top of the page.

- Look for the “Account Settings” or “Verification” section and click on it.

- Follow the instructions provided to complete the verification process.

- Typically, PayPal will require you to confirm your identity by providing additional information, such as your Social Security Number, National Identification Number, or other forms of identification.

- Verify your email address by clicking on the verification link sent to your registered email address. If you haven’t received the verification email, you can request a new one within your PayPal account settings.

Once you’ve completed the verification process, PayPal will review the information you provided, and once approved, your account will be verified. This process may take a few business days, so it’s important to be patient.

Verifying your account not only enhances the security of your transactions but also enables you to enjoy additional perks, such as increased sending and withdrawal limits. This is particularly beneficial for those who regularly engage in larger transactions or have a higher volume of financial activity.

In some cases, PayPal may request further documentation to verify your account, such as proof of address, proof of income, or business documentation if you have a business account. It’s important to follow the instructions provided by PayPal and submit the required documents promptly to facilitate the verification process.

Keep in mind that verifying your PayPal account is not mandatory, but it is highly recommended for a seamless and secure financial experience. Verified accounts inspire trust among buyers and sellers, giving you access to a wider network of potential transactions.

With your PayPal account verified, you can now confidently engage in various financial activities, such as sending and receiving larger amounts of money, withdrawing funds to your bank account, and exploring additional features offered by PayPal.

In the next sections, we will delve deeper into the functionalities of PayPal Wallet, including managing your PayPal balance, sending and requesting money, making online purchases, and much more.

Understanding PayPal Wallet

PayPal Wallet is more than just a digital payment platform; it’s a comprehensive financial tool that allows you to manage your funds, make secure transactions, and gain control over your online finances. To make the most out of PayPal Wallet, it’s important to understand its key features and functionalities. Here’s what you need to know:

PayPal Balance: Your PayPal Wallet includes a balance that you can use to make payments, send money, or receive funds. You can add money to your PayPal balance from your linked bank account or receive money from others. It provides you with a central pool of funds that you can use for various transactions.

Sending Money: With PayPal Wallet, you can easily send money to friends, family, or anyone with a PayPal account. Whether you’re repaying a debt, splitting a bill, or sending a gift, you can use the “Send Money” feature to transfer funds instantly. You can send money to an email address, mobile number, or directly to another PayPal account.

Requesting Money: If you need to request money from someone, PayPal Wallet allows you to do so effortlessly. The “Request Money” feature enables you to send a payment request to an individual or a group, specifying the amount and the purpose of the request. This simplifies the process of collecting payments for products, services, or shared expenses.

Online Purchases: PayPal Wallet is widely accepted as a payment method on numerous online platforms and e-commerce websites. When making an online purchase, you can select PayPal as the payment option and log in to your account to complete the transaction. This eliminates the need to enter your credit card or billing information, providing an added layer of security.

Security Measures: PayPal Wallet is renowned for its robust security measures that protect your financial information and transactions. With features such as encryption, fraud monitoring, and buyer and seller protection, PayPal ensures that your sensitive data and financial transactions are safeguarded.

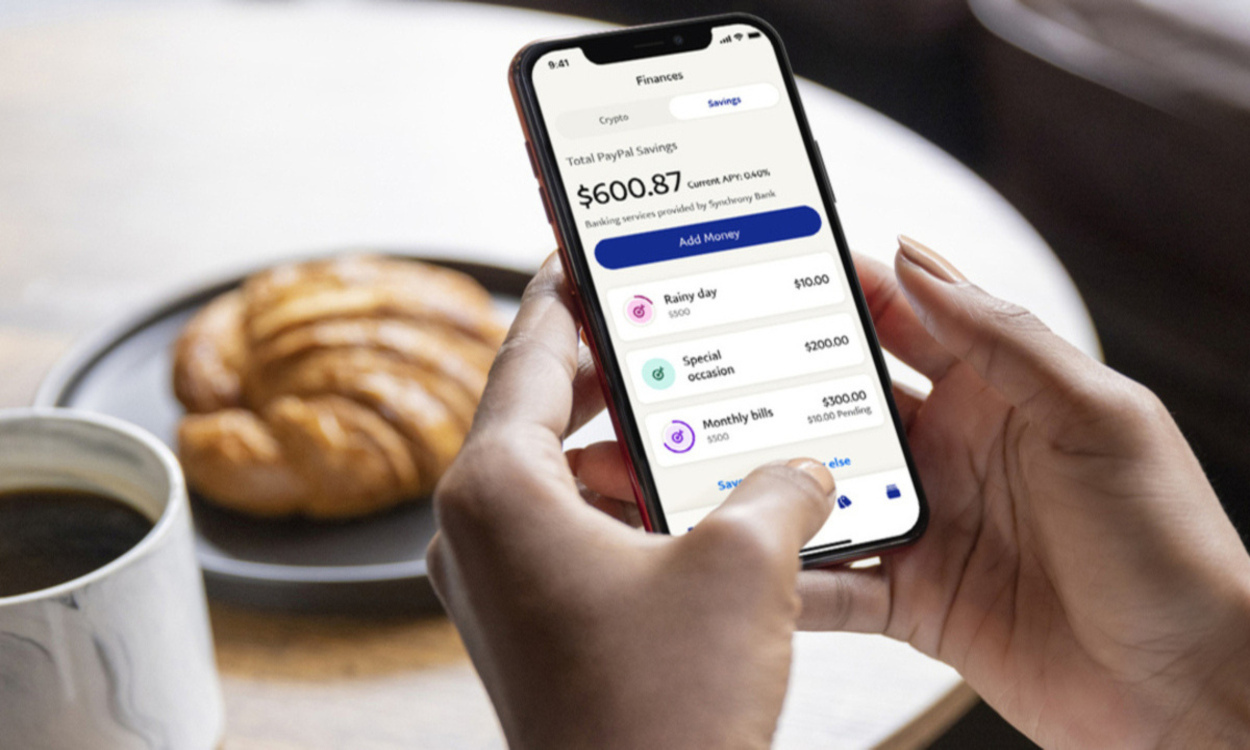

Mobile Access: PayPal Wallet offers a user-friendly and convenient mobile app, allowing you to manage your finances on the go. You can access your PayPal account, send and receive money, make mobile payments, and view your transaction history right from your smartphone or tablet.

By understanding the features and capabilities of PayPal Wallet, you can utilize its full potential to streamline your financial activities, simplify transactions, and maintain control over your online funds. Whether you’re a casual user making occasional purchases or a business owner managing transactions, PayPal Wallet provides the tools you need to navigate the digital financial landscape with ease.

In the following sections, we will explore in detail how to manage your PayPal balance, send and request money, make online purchases, withdraw funds, and other essential functionalities that will empower you to make the most of your PayPal Wallet.

Managing Your PayPal Balance

Your PayPal balance is a central component of your PayPal Wallet, acting as a virtual account where you can store funds and manage your financial transactions. Understanding how to effectively manage your PayPal balance is key to utilizing the full potential of your PayPal Wallet. Here’s what you need to know:

Understanding Your PayPal Balance: Your PayPal balance represents the amount of money available in your PayPal account. It includes funds you’ve added to your account from your linked bank account, funds received from others, and refunds from purchases.

Checking Your PayPal Balance: To view your PayPal balance, log in to your PayPal account and navigate to the “Summary” or “Wallet” tab. Here, you will find an overview of your PayPal balance, as well as your linked bank accounts, credit or debit cards, and other available funding sources.

Adding Money to Your PayPal Balance: If your PayPal balance is low or you want to ensure sufficient funds for your transactions, you can add money to your PayPal account. To do this, navigate to the “Wallet” tab, select “Add Money,” and follow the instructions to transfer funds from your linked bank account to your PayPal balance. It may take a few business days for the transfer to complete.

Withdrawing Funds: If you want to move money from your PayPal balance back into your bank account, you can easily withdraw funds. In the “Summary” or “Wallet” tab, click on “Withdraw Money” and choose your desired withdrawal method. You can transfer the funds to your linked bank account or receive a physical check by mail. Be aware that certain withdrawal options may incur fees or have minimum withdrawal amounts.

Managing Currency Balances: PayPal Wallet gives you the ability to hold balances in multiple currencies. This can be particularly advantageous if you frequently make international transactions or have income in different currencies. You can manage your currency balances by navigating to the “Summary” or “Wallet” tab and selecting “Manage Currencies.” Here, you can add, convert, or remove currency balances as needed.

Tracking Your Transactions: PayPal provides a transaction history log where you can view your incoming and outgoing payments, purchases, and transfers. This log allows you to keep track of your financial transactions, monitor your spending, and reconcile your PayPal activity with your bank statements if needed.

Setting Up Auto Sweep: Auto Sweep is a useful feature that allows you to automatically transfer funds from your PayPal balance to your linked bank account, helping you maintain a desired balance in your PayPal account. You can set up Auto Sweep by navigating to your PayPal settings and selecting the “Auto Sweep” or “Balance Manager” option.

By effectively managing your PayPal balance, you can ensure a smooth and efficient experience when making payments, sending money, or receiving funds. Regularly monitoring your balance, adding or withdrawing funds as necessary, and taking advantage of additional features like Auto Sweep will enable you to maintain control over your finances and use your PayPal Wallet to its maximum potential.

In the next sections, we will explore how to send and request money with PayPal Wallet, make online purchases, and other essential functionalities that will further enhance your financial management capabilities.

Sending Money with PayPal Wallet

One of the primary purposes of PayPal Wallet is to send money to friends, family, or anyone with a PayPal account. Whether you need to repay a debt, contribute to a group gift, or simply send money to someone in need, PayPal offers a seamless and secure way to transfer funds. Here’s how you can send money using PayPal Wallet:

- Log in to your PayPal account using your email address and password.

- Navigate to the “Send & Request” tab or a similar option. This may be located in the top menu or on the main dashboard of your PayPal account.

- Select the “Send Money” option.

- Enter the recipient’s PayPal email address, mobile number, or name. If the recipient is in your contacts, their name should appear as you type.

- Specify the amount you wish to send. If applicable, choose the currency in which you want to send the money.

- Choose the purpose of the payment. You can select options like “Sending to a Friend” or “Paying for Goods or Services.”

- Include a brief note or message if needed, such as a reason for the payment or any additional instructions.

- Review the details one last time to ensure accuracy.

- Click “Send” to initiate the transfer.

PayPal will process the payment and send a notification to the recipient, informing them of the incoming funds. The recipient will then have the option to accept the payment and add the funds to their PayPal balance or choose to transfer the funds to their linked bank account.

If the recipient does not have a PayPal account, they will receive an email or message inviting them to create a PayPal account in order to accept the payment. They can then follow the provided instructions to set up their account and access the funds you sent.

It’s important to note that when sending money with PayPal, there may be transaction fees involved, depending on the type of payment and the recipient’s country. PayPal will inform you of any applicable fees before you confirm the transaction.

Additionally, if you are sending money to another country or using a different currency, PayPal may apply a currency conversion fee. Make sure to review PayPal’s fee structure and exchange rates for international transactions to understand the potential costs involved.

Sending money with PayPal Wallet offers convenience, speed, and security. You can keep track of your sent payments in the transaction history of your PayPal account, allowing you to easily monitor your financial activity.

In the next section, we will explore how to request money using PayPal Wallet, making it easy to collect payments from others for products, services, or shared expenses.

Requesting Money with PayPal Wallet

PayPal Wallet provides a hassle-free way to request money from friends, family, or anyone with a PayPal account. Whether you need to collect payments for products or services, split expenses among a group, or request repayment for a loan, PayPal makes it easy to send payment requests. Here’s how you can request money using PayPal Wallet:

- Log in to your PayPal account using your email address and password.

- Navigate to the “Send & Request” tab or a similar option. This may be located in the top menu or on the main dashboard of your PayPal account.

- Select the “Request Money” option.

- Enter the recipient’s PayPal email address, mobile number, or name. If the recipient is in your contacts, their name should appear as you type.

- Specify the amount you want to request. If applicable, choose the currency in which the payment should be made.

- Choose the purpose of the payment request. You can select options like “Goods or Services” or “Personal.”

- Add a brief note or message to provide additional context for the payment request, if necessary.

- Review the details to ensure accuracy.

- Click “Request” to send the payment request.

Once you’ve sent the payment request, the recipient will receive a notification via email or message, informing them of the request. They will have the option to log in to their PayPal account, review the details of the request, and complete the payment accordingly.

The recipient can choose to pay the requested amount by using their PayPal balance, linked bank account, or credit/debit card. PayPal offers flexibility in payment options, allowing the recipient to use their preferred method to fulfill the payment request.

As the requester, you will receive a notification when the payment is made, and the funds will be added to your PayPal balance. You can then choose to keep the funds in your PayPal account for future use, withdraw them to your linked bank account, or use them for online purchases.

When requesting money with PayPal Wallet, it’s important to note that there may be transaction fees involved, depending on the type of request and the recipient’s country. PayPal will inform you of any applicable fees before you confirm the request.

Additionally, keep in mind that PayPal provides the option to create and send invoices for more formal payment requests, particularly for business transactions. Invoices allow you to include detailed information about your products or services, due dates, and payment terms to facilitate a smooth and professional payment process.

With PayPal Wallet’s request money feature, you can easily collect payments from others in a secure and efficient manner. By keeping track of your payment requests in the transaction history of your PayPal account, you can stay organized and ensure proper record-keeping for your financial transactions.

In the next section, we will explore how to make online purchases using PayPal Wallet, leveraging its wide acceptance and enhanced security features.

Making Online Purchases with PayPal Wallet

PayPal Wallet offers a secure and convenient way to make online purchases without the need to enter your credit card or billing information on multiple websites. PayPal is widely accepted by online merchants, making it a preferred payment option for millions of users worldwide. Here’s how you can use PayPal Wallet to make online purchases:

- When shopping online, look for the PayPal logo or the PayPal payment option at the checkout page of the website or online store.

- Select PayPal as your preferred payment method.

- You will be redirected to the PayPal login page. Enter your email address and password to log in to your PayPal account.

- Review the payment details on the PayPal checkout page, including the order total and shipping information. Make sure everything is accurate.

- Choose the funding source you want to use for the payment. You can select your PayPal balance, linked bank account, or credit/debit card.

- Click “Pay Now” or a similar button to complete the purchase.

Once the payment is processed, you will receive a confirmation of the transaction, both from the merchant and PayPal. The payment amount will be deducted from your chosen funding source, and the merchant will proceed with fulfilling your order.

One of the significant advantages of using PayPal Wallet for online purchases is the added layer of security. When paying with PayPal, you don’t have to share your payment information directly with the merchant. Instead, PayPal acts as an intermediary, keeping your sensitive financial details secure.

In case of any issues with the order or if you need to initiate a refund, PayPal’s Buyer Protection policy can offer added peace of mind. If a product doesn’t arrive as described or is damaged, you may be eligible for a refund through PayPal’s dispute resolution process.

It’s important to note that when using PayPal to make online purchases, there may be buyer and seller protection policies in place. Be sure to review PayPal’s terms and conditions, as well as the specific policies of the merchant, to understand your rights and responsibilities in the event of any disputes.

Furthermore, PayPal offers additional features like One Touch™, which allows you to stay logged in to your PayPal account on a trusted device or browser, enabling a seamless checkout experience. With One Touch™, you won’t have to enter your login credentials every time you make a purchase, making the payment process even more convenient.

With PayPal Wallet, you can enjoy a swift and secure online shopping experience. The widespread acceptance of PayPal as a payment method makes it easy to use across numerous e-commerce platforms and websites. So the next time you’re shopping online, look for the PayPal option and enjoy the convenience and peace of mind that comes with using PayPal Wallet.

In the next sections, we will explore how to withdraw funds from your PayPal Wallet, add money to your balance, and set up PayPal Wallet on mobile devices for seamless financial management on the go.

Withdrawing Funds from PayPal Wallet

With PayPal Wallet, you have the flexibility to withdraw funds from your PayPal balance and transfer them to your linked bank account. Whether you want to access your funds for personal use or need to move money to your primary banking institution, PayPal offers a straightforward process for withdrawing funds. Here’s how you can withdraw funds from your PayPal Wallet:

- Log in to your PayPal account using your email address and password.

- Navigate to the “Wallet” tab or a similar option to view your PayPal balance.

- Click on the “Withdraw Money” or “Transfer to Bank Account” option.

- Choose the linked bank account to which you want to transfer the funds.

- Enter the amount you wish to withdraw. You can either specify a specific amount or select the maximum available balance.

- Review the details to ensure accuracy, including the withdrawal amount and the destination bank account.

- Click “Continue” or a similar button to initiate the withdrawal.

PayPal will process the withdrawal request, and the funds will be transferred from your PayPal balance to your linked bank account. This process typically takes a few business days to complete, depending on your bank’s processing time.

It’s important to note that PayPal may impose fees for certain types of withdrawals or for expedited withdrawal options. Be sure to review PayPal’s fee structure to understand any associated costs.

In addition to withdrawing funds directly to your bank account, PayPal also offers other withdrawal options, such as requesting a physical check or transferring funds to a linked debit card. These alternative withdrawal methods may have different processing times and potential fees, so be sure to explore the options available to you through your PayPal account.

By withdrawing funds from your PayPal Wallet, you can access your money for personal use or to cover expenses outside of the digital realm. It’s important to ensure that your linked bank account information is accurate and up to date to avoid any issues during the withdrawal process.

Now that you know how to withdraw funds from your PayPal Wallet, let’s move on to the process of adding money to your PayPal balance. Adding funds to your PayPal Wallet provides you with more flexibility and ensures you have sufficient funds for your transactions and payments.

Adding Money to PayPal Wallet

Adding money to your PayPal Wallet is a quick and convenient way to ensure that you have funds available for your transactions and payments. Whether you want to maintain a balance for future use or need to top up your account for a specific purchase, PayPal offers multiple options for adding money to your wallet. Here’s how you can add money to your PayPal Wallet:

- Log in to your PayPal account using your email address and password.

- Navigate to the “Wallet” tab or a similar option to view your PayPal balance.

- Click on the “Add Money” or “Transfer from Bank” option.

- Choose the linked bank account from which you want to transfer the funds. If the bank account is not already linked, you may be prompted to add and verify it.

- Enter the amount you wish to add to your PayPal balance. You can either specify a specific amount or select from predetermined options.

- Review the details, including the transfer amount and the source bank account.

- Click “Continue” or a similar button to initiate the transfer.

PayPal will process the money transfer from your bank account to your PayPal balance, and the funds will be available in your wallet within a few business days, depending on your bank’s processing time.

In addition to adding money from your linked bank account, PayPal also offers alternative methods for topping up your PayPal Wallet. You can explore options such as adding money from a linked debit or credit card, receiving funds from others, or using PayPal Cash, depending on the availability in your region.

Remember to verify that your linked bank account or card information is accurate and up to date to avoid any issues during the transfer process.

It’s important to note that while adding money to your PayPal Wallet is free, some types of transfers or funding sources may incur fees. Make sure to review PayPal’s fee structure to understand any associated costs.

By adding money to your PayPal Wallet, you can maintain a balance and have funds readily available for your online transactions. This can streamline the payment process and provide added convenience, especially when making multiple purchases or regularly using PayPal as your preferred payment method.

Now that you know how to add money to your PayPal Wallet, let’s explore how to set up and manage PayPal Wallet on your mobile devices for seamless financial management on the go.

Setting Up PayPal Wallet on Mobile Devices

Setting up PayPal Wallet on your mobile device allows you to conveniently manage your finances on the go, making it easy to send money, receive payments, and make online purchases from the palm of your hand. Whether you have an Android or iOS device, here’s how you can set up PayPal Wallet on your mobile device:

- Download the PayPal app from the Google Play Store (Android) or the App Store (iOS).

- Open the PayPal app and tap on “Sign Up” or “Get Started.”

- Choose the type of account you want to create – Personal or Business.

- Enter your email address and create a unique password for your PayPal account.

- Complete the required information, such as your name, address, and phone number.

- Agree to the terms of service and privacy policy.

- Verify your email address by clicking on the verification link sent to your registered email.

- Set up additional security measures, such as a PIN or fingerprint authentication, to ensure the safety of your account.

- Link your bank account and/or credit/debit card to your PayPal account for easy access to your funds.

- Review and customize your account settings, including notification preferences and security options.

Once you’ve completed these steps, your PayPal Wallet is set up on your mobile device, and you can start using the app to manage your finances on the go.

The PayPal mobile app offers a user-friendly and intuitive interface, allowing you to access your PayPal balance, send money, request payments, and make online purchases with a few taps. You can also view your transaction history, manage your settings, and receive notifications about your financial activity.

With the mobile app, you can take advantage of features like One Touch™, enabling a seamless checkout experience by staying logged in to your PayPal account on trusted devices. This eliminates the need to repeatedly enter your login credentials when making purchases.

It’s important to keep your mobile device and the PayPal app up to date to ensure you have the latest security patches and features. Regularly check for app updates in your device’s app store or enable automatic updates for the PayPal app.

In addition to the mobile app, PayPal also offers a mobile website that allows you to access your PayPal account and perform basic functions from any internet browser on your mobile device. Simply navigate to the PayPal website and log in using your email address and password.

Setting up PayPal Wallet on your mobile device provides you with the flexibility and convenience of managing your finances wherever you are. Whether you need to send money to a friend, pay for goods or services, or keep track of your transactions, the PayPal mobile app makes it all possible with just a few taps.

In the following sections, we will explore how to manage notifications and security settings on your PayPal account, as well as provide troubleshooting tips for common issues.

Managing Notifications and Security Settings

Managing notifications and security settings on your PayPal account is essential for keeping your financial information secure and staying informed about your transactions. PayPal provides a range of customizable options to ensure that you receive important alerts and maintain control over your account’s security. Here’s how you can manage notifications and security settings on your PayPal account:

Notifications: PayPal offers various notification preferences that you can customize according to your preferences. These notifications keep you informed about important account activity, such as transaction updates, account changes, and security alerts. To manage your notifications:

- Log in to your PayPal account using your email address and password.

- Go to your account settings or profile settings.

- Look for the “Notifications” or “Notifications Preferences” section.

- Choose the types of notifications you want to receive via email, text message, or both.

- Save your preferences to apply the changes.

Security Settings: Protecting your PayPal account is crucial. PayPal provides several security options to safeguard your account against unauthorized access and fraudulent activity. To manage your security settings:

- Log in to your PayPal account using your email address and password.

- Go to your account settings or profile settings.

- Look for the “Security” or “Security Settings” section.

- Review and update your security settings, including:

- Adding a PIN or setting up fingerprint authentication for easier login on supported devices.

- Enabling two-factor authentication for an additional layer of security during sign-in.

- Reviewing and managing trusted devices that you’ve used to access your account.

- Setting up transaction notifications or alerts to monitor activity on your account.

- Reviewing and managing your authorized merchant payments and pre-approved payments.

- Updating your password and security questions periodically.

- Save your settings to apply the changes.

By managing your notifications and security settings, you can stay informed about your PayPal account activity and take proactive steps to protect your finances. Regularly reviewing and updating these settings ensures that your account security remains up to date.

It’s important to note that PayPal may also provide additional security features, such as buyer and seller protection policies, which can offer added peace of mind for certain transactions. Familiarize yourself with PayPal’s terms and conditions, as well as the specific policies related to your account and region.

By actively managing your notifications and security settings, you can have better control over your PayPal account and ensure a safe and secure financial experience.

In the final section, we will provide some troubleshooting tips to help you address common issues that may arise during your interactions with PayPal Wallet.

Troubleshooting Tips

While PayPal Wallet is designed to provide a smooth and secure financial experience, you may encounter occasional issues or challenges. Here are some troubleshooting tips to help you address common problems that you may face when using PayPal Wallet:

1. Verify Your Information: Double-check that your personal information, including your email address, is accurate and up to date. Incorrect information can lead to issues with accessing your account or completing transactions.

2. Check Your Internet Connection: Ensure that you have a stable internet connection when using PayPal Wallet. A weak or unreliable connection can cause delays or errors during the payment process.

3. Clear Your Browser Cache and Cookies: If you’re experiencing issues on the PayPal website, try clearing your browser cache and cookies. This can resolve compatibility or loading issues that may arise.

4. Confirm Funds Availability: Make sure you have sufficient funds in your PayPal balance or linked accounts before making a payment or sending money. Insufficient funds can result in transaction failures or delays.

5. Check Transaction Limits: Verify if you’ve reached any transaction limits imposed by PayPal based on your account status or previous activity. Adjustments may be required to successfully complete your transaction.

6. Contact Customer Support: If you encounter an issue that you’re unable to resolve on your own, reach out to PayPal’s customer support. They can provide guidance, troubleshoot the problem, and offer solutions tailored to your specific situation.

7. Review Account Activity: Regularly review your transaction history and account activity to identify any suspicious or unauthorized transactions. Promptly report any unauthorized activity to PayPal for further investigation.

8. Update Your App: If you’re using the PayPal mobile app, make sure you have the latest version installed on your device. Keeping your app up to date ensures access to the latest features, security patches, and bug fixes.

9. Review PayPal’s Help Center and Community Forums: PayPal provides extensive online resources, including their Help Center and community forums, where you can find answers to commonly asked questions and discover solutions to a wide range of issues.

10. Be Wary of Phishing Attempts: Be cautious of any emails or messages claiming to be from PayPal that ask for your personal or financial information. PayPal will never ask for such information via email or messages. Report any suspicious emails or messages to PayPal.

Remember, if you encounter any technical or account-related issues with PayPal Wallet, it’s always best to reach out to PayPal’s customer support for personalized assistance. They have the expertise to help resolve any problems and ensure a smooth experience with PayPal Wallet.

By following these troubleshooting tips and staying proactive, you can overcome common challenges and make the most of PayPal Wallet’s convenient and secure features.

With this comprehensive guide, you now have the knowledge and tools to effectively manage your PayPal Wallet, send and receive money, make online purchases, and navigate the digital financial landscape with confidence. Enjoy the convenience and peace of mind that PayPal Wallet brings to your financial management.

Have a successful and seamless experience with PayPal Wallet!

Conclusion

Congratulations! You have now gained a comprehensive understanding of PayPal Wallet and how to effectively utilize its features to manage your finances online. PayPal Wallet offers a convenient and secure way to send and receive money, make online purchases, and keep track of your transactions.

Throughout this guide, we covered the process of creating a PayPal account and linking your bank account and credit or debit card to your PayPal Wallet. We also explored how to verify your account and discussed the various functionalities of PayPal Wallet, such as managing your PayPal balance, sending and requesting money, and making online purchases.

We also provided guidance on withdrawing funds from your PayPal Wallet, adding money to your balance, setting up PayPal Wallet on mobile devices, and managing notifications and security settings. Troubleshooting tips were shared to help you address common issues that may arise during your interactions with PayPal Wallet.

It’s important to remember that PayPal prioritizes the security of your financial information, with features like encryption, fraud protection, and buyer and seller protections. Take advantage of additional security measures such as two-factor authentication and transaction notifications to enhance the security of your PayPal account.

We encourage you to explore and familiarize yourself with PayPal’s website, mobile app, and online resources to stay informed about PayPal’s policies, fees, and any updates or enhancements to its services.

Now that you’re equipped with this knowledge, you can confidently manage your finances with PayPal Wallet. Enjoy the convenience, security, and peace of mind that PayPal brings to your online transactions.

We hope this guide has been informative and helpful as you navigate the world of PayPal Wallet and its myriad features. Feel free to refer back to this guide whenever you need a refresher or encounter any questions along the way.

Thank you for choosing PayPal Wallet, and best of luck on your financial journey!